The Money Savings Program: Laying the Groundwork for a Brighter Future

“I see the Mission as a landing pad that serves as a launching pad for a brighter future. That’s why we’re committed to assisting our guests with their present needs while always moving them forward. – Jonathan Anderson

“One bad turn deserves another.” Or so conventional wisdom would tell us. Some would call it “bad karma”— as in you get what you deserve. Yet while it’s true our poor choices lead to reaping what we sow, you can’t minimize the power of grace — God’s unmerited favor — operating in our lives to turn what “the enemy meant for evil into good.”

Take how we handle our money. This is just one area where the thief comes to “steal, kill and destroy” — wreaking havoc in people’s lives. Either they once had money but lost it due to no fault of their own, or through “riotous living.” That’s the Bible’s description of the prodigal son’s indulgent lifestyle after demanding an early inheritance from his father and hightailing it out of Dodge. The son took the money and ran — ending up on a dung heap eating pig slop. No doubt, “Dodge” was looking pretty good by then.

Then there are the people who grew up in poverty and stayed stuck there because they didn’t know anything else. They never saw anyone in their family or in their group of friends break free from the shackles of generational poverty. Nor were they given the basic tools to learn how to work hard, save money and invest in their future.

This latter category describes many of the people whose stories you will read here. Many were birthed into generational poverty. It probably didn’t help that once upon a time, Redding was known as “Poverty Flats.” That negative moniker bestowed upon the area didn’t do it any favors. Some might contend the city was cursed from the git go.

What’s in a Name?

But God is bigger than a name, and more powerful than a curse. As we’ve seen many times with those who come to the Mission in need of help, people who have been “cursed” with a poverty mindset can break free; that is, IF they can begin to SEE themselves not as a victim of their circumstances, but rather as “Imago Dei” — humans created in the image of God in their moral, spiritual, and intellectual essence. It was never the Creator’s intention for his “imago dei” to be a victim of every circumstance the god of this world tries to throw at us. The devil, “the proude spirite” has only one mission and that is to weaken or take out humanity–in whatever way he can. And he’s good at it. After all, he’s had centuries of practice. In contrast, Jesus’ states his purpose unambiguously: I have come to”give life and give it more abundantly” (John 10:10).

At some point in their journey, the men and women whose stories you will read here, came to that realization. They responded to His unconditional love by embracing their new identity. As “new creatures in Christ” their eyes were opened to a different life, including their relationship with money. On the street, they lived a “survival-of-the fittest-grab-what-you-can-while-you-can” type of existence. That changed once they came to the Mission. After being loved on, encouraged and coached, they had a strong prospect for a brighter future. Of course not everyone is capable, or even wants to have that. They’re stuck in the same groove, playing the same old tired and self-defeating song.

The Money Savings Program: The Ins and Outs

“A feast is made for laughter, and wine maketh merry: but money answereth all things.” – Ecclesiastes 10:9

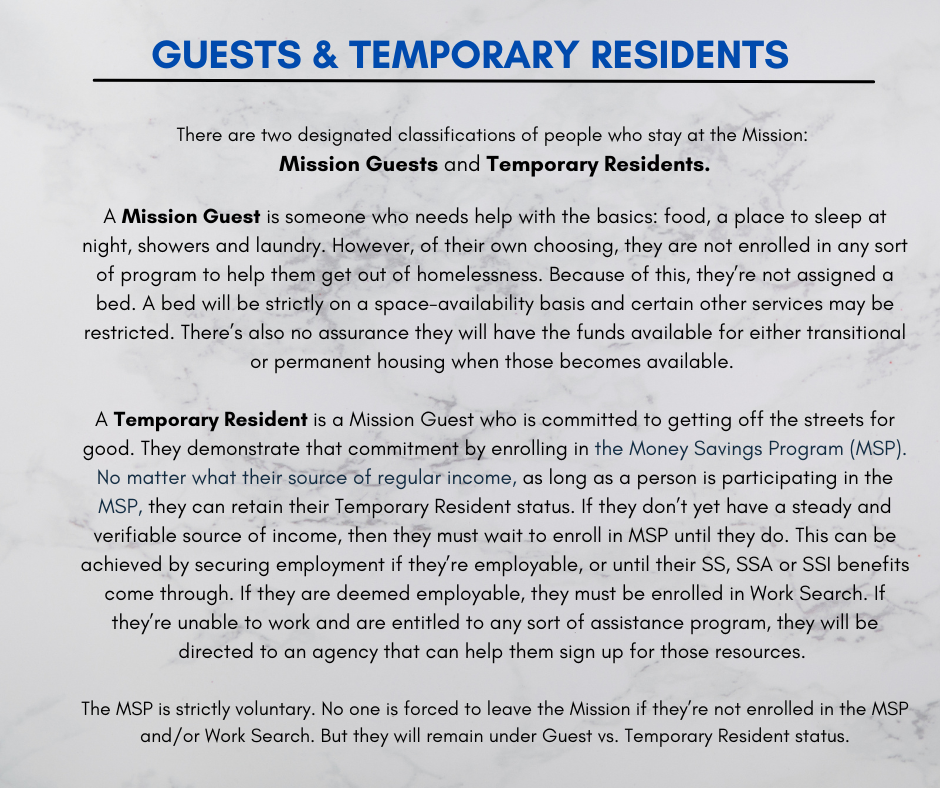

Initiated in 2009, the MSP was designed to help guests save money in a structured and accountable way so they could eventually secure permanent housing and stay off the streets. That’s why we’re committed to assisting our guests with their present needs while always moving them forward.

A big part of moving forward in life is how we handle our money—a skill that most people coming into the Mission don’t possess for a host of reasons. And yet, handling our money wisely is critical. After all, the Bible mentions “money” over 2,000 times—even more than verses about prayer and faith which are only referenced 500 times!

How It Works: The Steps to Savings

The Contract: Once a guest agrees to participate in the MSP, a contract is signed. The requisite 80% is then taken out of each paycheck, with 20% to be kept for expenses. (Expenses for temporary guests are minimal since room and board is covered.)

Another option for those who are disabled is to save their money through a state program called CalAble though that also has to be verifiable.

Proof of Income Requirements. Ideally, temporary residents must provide three paystubs to quality for the MSP; however, Cassie Coonce, the Mission’s Guest Services Manager in charge of MSP, will sometimes take two. “Having three paystubs makes it easier to figure out what their income is so I can determine what they can afford,” says Cassie.

Required Minimum: MSP participants are required to save a minimum of $650 a month for the simple reason if they can’t save $650 a month, they can’t pay rent. These monies can come through work or some other verifiable and consistent source. “They need to increase their income somehow,” says Cassie. “So they have to be enrolled in Work Search. If they’re not able to do that, then they have to figure out some other way to increase their income, whether that’s getting on social security or lowering their bills.”

While $650 hardly seems realistic in today’s inflated market—even for a room—that minimum has remained the same. While Cassie agrees that number should be higher, she says it’s unrealistic to expect most temporary residents to be able to save much more than that.

Allowed Reasonable Expenses Using the 80/20 ratio, allowable expenses are monthly bus passes, gas to and from work, church or Bible studies, drug and alcohol classes, medical expenses, car insurance, work clothes, childcare, child support, court fines, cell phones expenses, etc. And in some cases, storage.

“It’s Your Money!”

With the new rules and procedures in place, it’s easier than ever to save money for future housing for those who truly want that. That being said, there will always be people who are just naturally distrustful. Double that for people who are living on the street and suffer from mental health challenges. Then there are those who just want to keep all of their money even though no one is ever forced to participate in our MSP. There’s always a choice.

Win-Win-Win

The Money Savings Program is a win-win for everyone: (1) Temporary Residents, (2) Families of Residents and (3) the Community.

It’s a win for the Mission’s Temporary Residents because it instills hope for the future—a commodity that many people experiencing homelessness don’t have. Being future minded encourages long-term thinking and planning. Even before a job and housing may materialize, a serious saver cultivates a feeling of stability and security because they can see the result of their saving and planning. They can see it both in the amount of money they’re saving and by the constant encouragement they’re being given at the Mission by staff and volunteers to “keep on keeping on.” They’re also inspired and encouraged by all the former residents who were enrolled in the MSP, have left the Mission and are doing well. And finally, they are building a habit of saving which in the future will mean having to say “no” to a lot of things—both bad and good.

It’s a win for the Mission’s Temporary Residents because it instills hope for the future—a commodity that many people experiencing homelessness don’t have. Being future minded encourages long-term thinking and planning. Even before a job and housing may materialize, a serious saver cultivates a feeling of stability and security because they can see the result of their saving and planning. They can see it both in the amount of money they’re saving and by the constant encouragement they’re being given at the Mission by staff and volunteers to “keep on keeping on.” They’re also inspired and encouraged by all the former residents who were enrolled in the MSP, have left the Mission and are doing well. And finally, they are building a habit of saving which in the future will mean having to say “no” to a lot of things—both bad and good.

Of course, it’s the most rewarding when that job and/or housing finally does materialize and that Mission Temporary Resident finally gets to be a Permanent Resident of Shasta County! There’s no greater feeling than knowing you have a place to call home, with a bright future in front of you to create and build for posterity.

It’s a win for families of the residents. Once an individual is able to show tangible signs of a changed life—one of stability and security as evidenced by a job and/or a place to live, then there is a greater chance of mending broken family relationships and, in some cases, regaining custody of minor children. It’s no secret that intact and healthy families help build strong communities.

It’s a win for the community. As a Mission Resident makes tangible strides at putting down roots in the community, they have a greater potential of becoming a productive member of the community. They work, shop, pay taxes, grow families and get involved—all of which builds a better future for everyone.

The Brave Ones

No matter who we are, how we handle our money is usually a reflection of how the rest of our life is faring. As someone once said, “Money only magnifies who you really are.” At some point in their journey, the men and women whose stories you will read on our blog, came to that realization and, in so doing, have managed to turn their lives around. On a practical level, that transformation often starts in the area of finances. That’s what our Money Savings Program does: It helps to build trust, confidence and self-esteem.

These men and women deserved to be cheered on from the stands as they run the race set before them. They are the brave ones. Contrary to Hollywood’s version of how the world works, at least from the Creator’s perspective, ultimately the crown for winning the race doesn’t belong to the swift…but rather to those who rely on the empowering grace of God to stay in the race—even when they falter and faint or have to limp their way to the finish line. If we run the race in His strength, for His glory, ultimately that’s all that matters. Because no matter who we are, or what our status, we are all just Temporary Residents of this world and this earthly habitation our proving ground.

READ MONEY SAVINGS STORIES:

“When I Was Sick”: Russ’s Money Savings Story

A Father Finds a Way to Be Near His Hospitalized Daughter

When a Landing Pad Becomes a Launching Pad: Marnie’s Money Savings Story

What happens when a refined woman with a once-glamorous career and a wealthy husband finds herself facing life on the street?

A Gift of Time: Jennifer’s Money Savings Story

After her mom died, 20-something year-old Jennifer was all alone in the world. She became homeless and turned to shoplifting to survive,

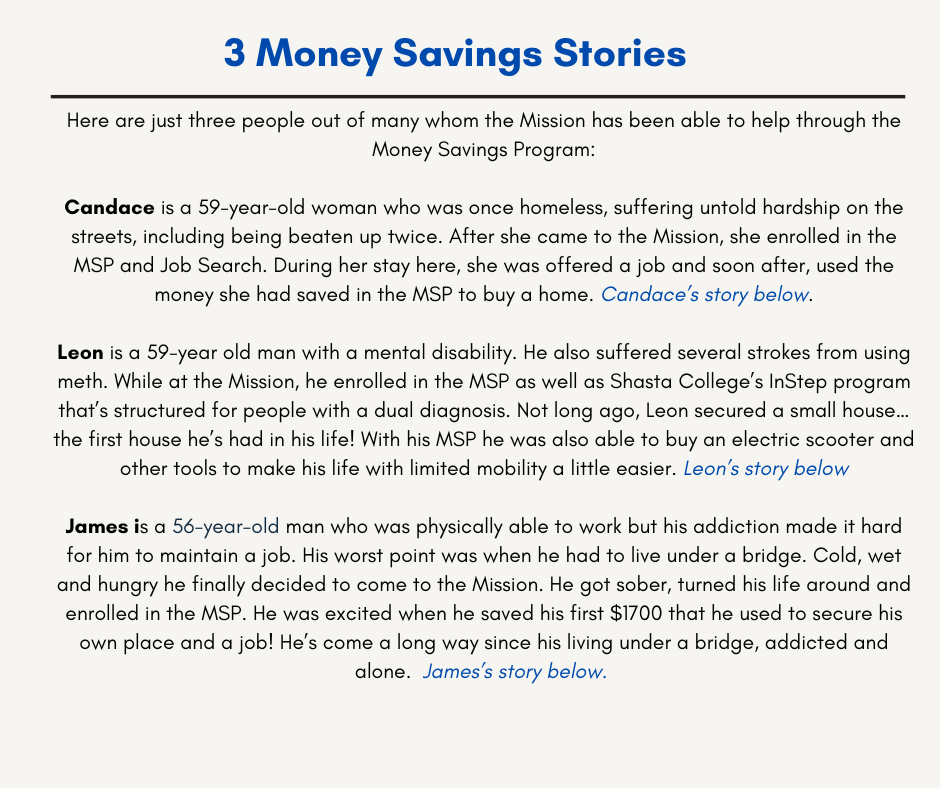

A Dream Deferred: Leon’s Money Savings Story

At 57, Leon was finally able to save money for something he had dreamt of his entire life.

When Life Beats You Up: Candace’s Money Savings Story

She was homeless and suffering unspeakable hardship, including being beaten up… twice.

A Bridge to a Better Life: James’ Money Saving Story

He was just a guy who took a downward turn after he lost a family member. Before he knew it, he was living under a bridge—cold, wet and hungry and always having to watch his back.